25+ mortgage to salary ratio

Web To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032. Web The 25 rule allows borrowers to use their net income in calculations which may be easier for borrowers who are unsure about their gross monthly income.

How Much Should I Pay For Healthcare Healthcare Affordability Ratio

In general the lower the percentage the better the chance you will be able to.

. Save Real Money Today. Using this model you can spend up to 1250 on your monthly mortgage payment. Web According to the 2836 rule your mortgage payment -- including taxes homeowners insurance and private mortgage insurance -- shouldnt go over 28.

Web Homebuyers I cannot stress enough the importance of your Debt-to-Income DTI ratioYour DTI is a crucial factor in determining whether you qualify for a mo. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web A low debt-to-income ratio demonstrates a good balance between debt and income.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Lock Your Rate Today. Find A Lender That Offers Great Service.

Web To calculate how much house you can afford use the 25 rulenever spend more than 25 of your monthly take-home pay after tax on monthly mortgage. Web If John is able to both reduce his monthly debt payments to 1500 and increase his gross monthly income to 8000 his DTI ratio would be calculated as. You may hear your lender use the term front-end ratio This is the ratio of your monthly housing expenses versus your monthly gross income and.

Multiply that by 100 to get a. Ad 10 Best Home Loan Lenders Compared Reviewed. Ad Compare Home Financing Options Get Quotes.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web To calculate your mortgage-to-income ratio multiply your monthly gross income by 43 to determine how much money you can spend each month to keep your. For example lets say your pre-tax monthly income is 5000.

Web To calculate your front-end ratio add up your monthly housing expenses only divide that by your gross monthly income then multiply the result by 100. Well help you every step of the way via our new online application. Ad Compare More Than Just Rates.

Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and. Web You can find this by multiplying your income by 28 then dividing that by 100. Web Less than 20 on my income.

Comparisons Trusted by 55000000. Web To calculate how much you can afford with the 25 post-tax model multiply 5000 by 025. Standard FHA guidelines accept a ratio as high as 43.

Heres what to know. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web The salary 100000 and mortgage rate 3125 remain the same.

Your maximum monthly mortgage. Ad Compare More Than Just Rates. Check How Much Home Loan You Can Afford.

Ad Ready To Apply. Web The 28 front-end ratio. Get Instantly Matched With Your Ideal Mortgage Lender.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Web Mortgage lenders typically look for debt-to-income ratios of 36 or lower. Ad Increasing Mortgage Payments Could Help You Save on Interest.

Find A Lender That Offers Great Service. Borrow up to 8 times your salary with a big down payment Lets assume you can make a. Partner SAHP and I bought a new construction townhouse in late 2019 with the VA loan and closed in 2020 with a sub 4 interest rate and.

Our Experts Are Committed To Helping Customers Find Their Best Home Loan Solution. Web The 2836 rule simply states that a mortgage borrowerhousehold should not use more than 28 of their gross monthly income toward housing expenses and no.

Household Income In The United States Wikipedia

How Much Of My Income Should Go Towards A Mortgage Payment

How Much Of My Income Should Go Towards A Mortgage Payment

Abrivia Salary Survey 2014

How Much Of My Income Should Go Towards A Mortgage Payment

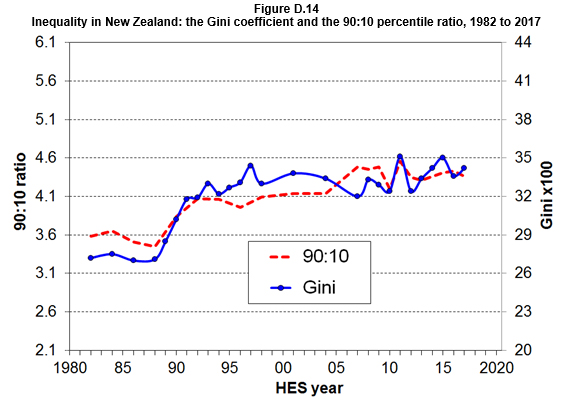

Are We Better Off Interest Co Nz

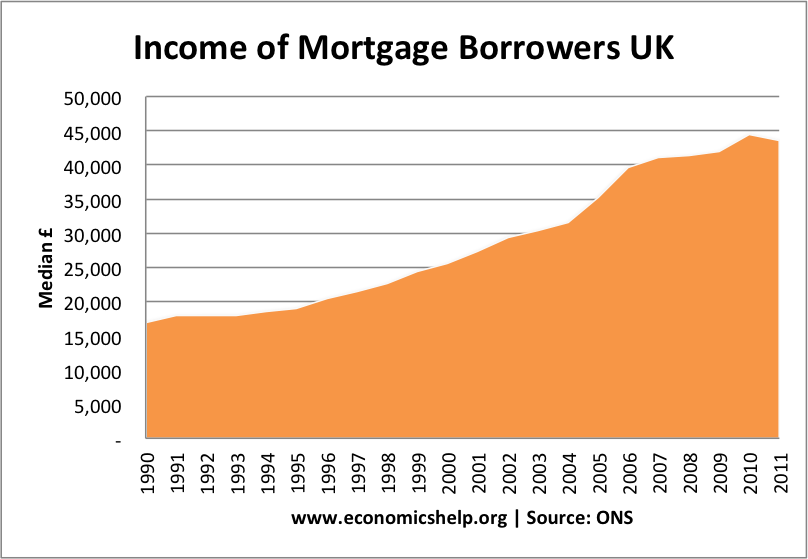

Uk House Price To Income Ratio And Affordability Economics Help

Liberty Home Mortgage Wv Ripley Wv

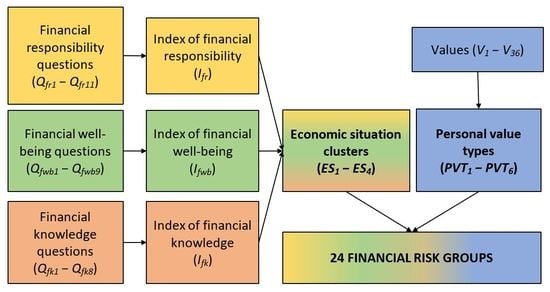

Risks Free Full Text Value Based Financial Risk Prediction Model

Rdp 2020 03 The Determinants Of Mortgage Defaults In Australia Evidence For The Double Trigger Hypothesis Rba

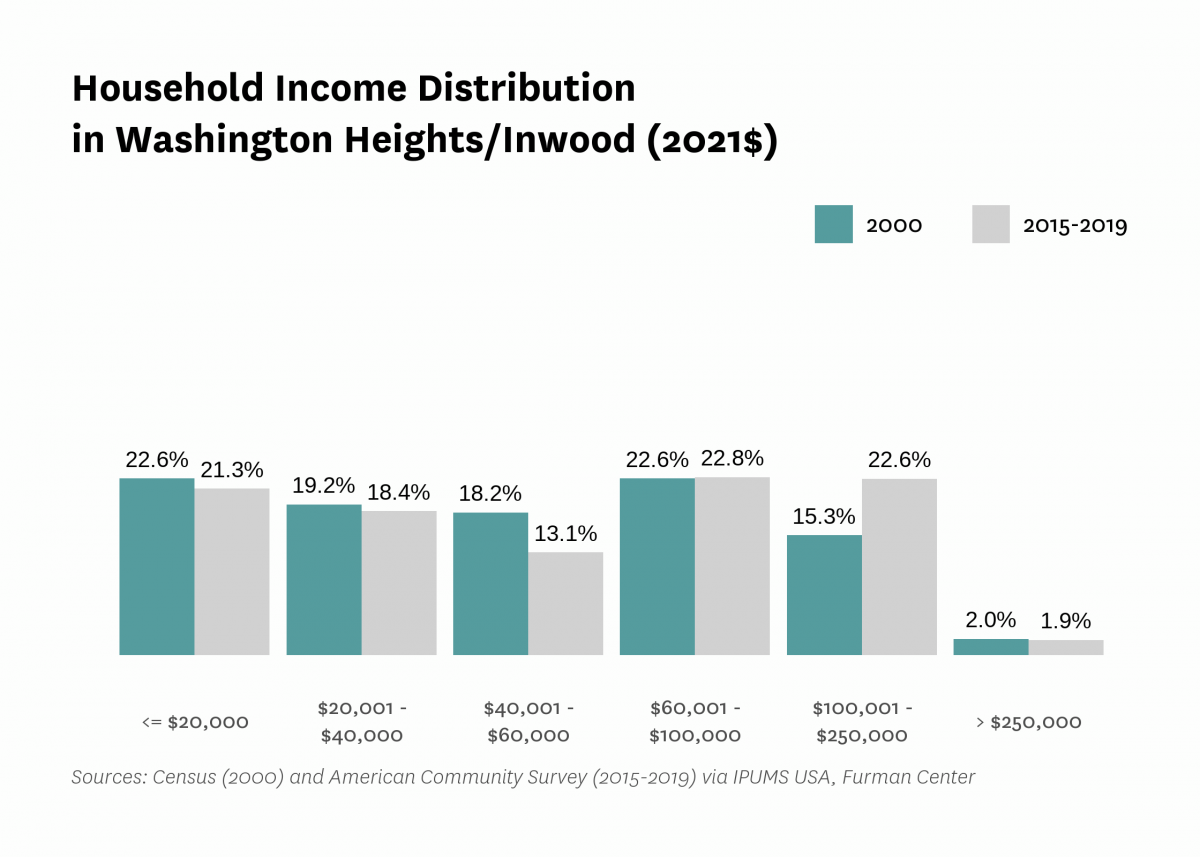

Washington Heights Inwood Neighborhood Profile Nyu Furman Center

How Much Should I Pay For Healthcare Healthcare Affordability Ratio

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

Should I Pay Off My Loan Early Advance America

Ex 99d1g019 Jpg

Buying An Apartment In Munich Does Not Make Sense Financially Today Contradict Me R Munich

Need A Mortgage Keep Debt Levels In Check The New York Times